West Red Lake Gold – More High-grade Gold Assays Returned From The Austin and McVeigh Zones Feeding Into The Mineral Inventory For The Madsen Mine Restart

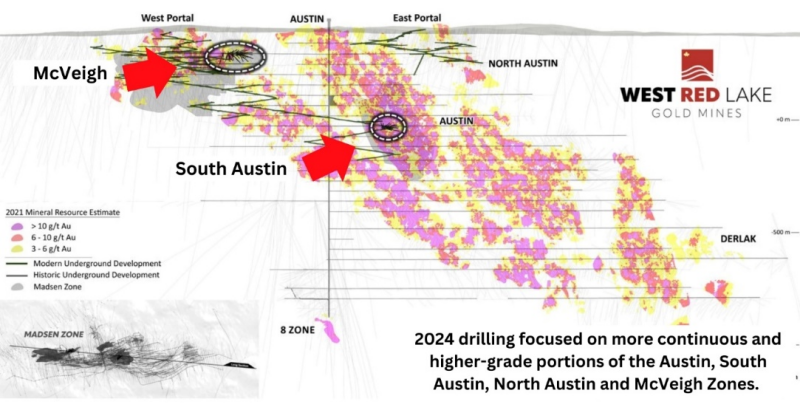

Will Robinson, VP of Exploration at West Red Lake Gold Mines (TSX.V:WRLG – OTCQB:WRLGF), joins us to review some of the recent wide high-grade gold drill intercepts returned from the Main Austin Zone and McVeigh Zone. These exploration results feed into the delineation of resources and to continue building an inventory of high-confidence ounces to support the restart of production at the Madsen Mine, in the Red Lake district of Ontario, Canada.

- Drill Hole # MM24D-09-4796-018 in the Austin Main Zone intersected 2.5m @ 107.61 g/t Au, from 80.0m to 82.5m, Including 1m @ 252.10 g/t Au, from 80m to 81m, Also including 1m @ 14.22 g/t Au, from 81m to 82m.

- Drill Hole # MM24D-01-4081-019 in the McVeigh Zone intersected 2.35m @ 106.99 g/t Au, from 37.65m to 40.00m, Including 0.5m @ 13.32 g/t Au, from 37.65m to 38.15m, Also Including 0.5m @ 479.09 g/t Au, from 39.0m to 39.5m.

Will points out that there were a number of drill holes also reported in this news release from both zones with wide 3-meter up to 11-meter high-grade intercepts that were both meaningful as well as mineable in a development scenario. The Austin Zone currently contains the majority of the mineral inventory with an Indicated mineral resource of 914,200 ounces (“oz”) grading 6.9 grams per tonne (“g/t”) gold (“Au”), with an additional Inferred resource of 104,900 oz grading 6.5 g/t Au. The McVeigh Zone currently contains an Indicated mineral resource of 79,800 oz grading 6.4 g/t Au, with an additional Inferred resource of 14,300 oz grading 6.9 g/t Au.

We also review the potential at depth at Madsen with both the South Austin Zone still open, at a new target called the Upper 8, at the Wedge/MJ area, and then also some underground drilling work planned for this Q4 at the 8-Zone. Underground drilling of these targets will allow the exploration team to follow up on these areas with more accuracy, and much more efficient holes, than trying to drill from surface as prior operators had done. There will also be a lot of regional exploration work on surface testing the thesis of periodicity of the mineralization and overlaying soil work with geophysical surveys.

If you have any follow up questions for the team over at West Red Lake Gold please email us at Fleck@kereport.com and Shad@kereport.com.

- In full disclosure, Shad is shareholder of West Red Lake Gold Mines at the time of this recording.

.

Click here to visit the West Red Lake Gold website and read over the recent news we discussed.

.

EV’s for now are dead meat. The biggest drawback is the amount of copper that will be needed from the power station to the charging station. There are still 1 billion people on our planet who are not hooked up to the electrical grid. The people that support EV’s like The World Economic Forum don’t have a clue about the infrastructure build out. The cars are not the problem they can be built it is the supply of copper needed to get the power to its source as well as a constant steady supply of electrical energy. These same politicians keep touting solar and wind power, this is The Twilight Zone we are living in. Battery driven vehicles are good for golf courses and boomer buggies in Florida’s old age homes. DT

Not to mention generating capacity. In any given neighborhood here in the good ol’ USA, when up to 5 or 6 people with electric cars try to charge them at the same time, it can overload the grid.

Thanks for the update on WRL. I have been in and out several times on this one and always looked at it as another Great Bear type of property. However, it sounds like they have come up with a better plan to deal with what Pure Gold ran into when not quite ready for production. The big plus is the funds expended on this property getting it ready that were purchased cheaply.

Hi Lakedweller2 – With WLRG they may actually have both the Great Bear type of mineralization in their “Confederation Assembly” package of rock types, as well as the high-grade zingers at depth (like the Red Lake Gold Mine nearby) in their “Balmer Assembly” package of rocks where most of the gold mineralization has historically been looked for.

That is why may folks have been enticed by the limited drilling that Pure Gold did into that 8-Zone (which showed a lot of promise and bonanza grades), and that it may be similar to the pockets of high-grade at depth that put Goldcorp more on the map under Rob McEwen’s tenure. The exploration team at West Red Lake Gold will be drilling the 8-Zone from underground in Q4 of this year.

It was also very intriguing to get those comments from Will in the interview above about the new drill targets “Upper 8” at a more shallow depth and MJ near Wedge, both as another potential 8-Zone “look alikes.” If they can find and define a few of those high-grade pockets of condensed gold, like what they find over at the Red Lake Gold Mine (currently operated by Evolution Mining) then it could be game on for WRLG. Then if they can also test the thesis with the Confederation assembly of rocks for more “Great Bear esq” types of gold mineralization, then it will be icing on the cake.

When I interviewed the CEO, Shane Williams, of West Red Lake Gold a few months back, he also got into the Great Bear analogies in their similar rock types and was pretty animated about it.

Here is a hotlink that should take you to that part of the interview where Shane is discussing that:

What gets me personally animated by West Red Lake Gold, and why I’m now a biased shareholder, is their longer-term vision to get the Madsen Mine up and producing and generating revenues, but then to use that a platform for rolling up other assets.

Frank Giustra had a great interview over on Rick Rule’s channel, where he was sharing his history building many successful companies, but then towards the end he shared his high-level plans for a few of his current companies like Aris Mining and West Red Lake Gold. He wants to use them both to accumulate other projects and companies until they are mid-tier producers. This makes all the sense in the world, but I think this vision is lost on so many investors that can’t get past their initial disbelief and skepticism that they’ll be able to successfully get the Madsen Mine back into production, much less grow into a mid-tier producer over the fullness of time.

_______________________________

This link should take anybody interested directly to that part of the discussion with Frank and Rick, and people can hear it directly from his own mouth of what his larger plan is for WRLG. 😉

Well, I ended up getting so geared up on all the factors coming together that were alluded to above, that I just went ahead and did a write-up on West Red Lake Gold Mines on my Substack channel.

__________________________________

Opportunities In Gold Explorers and Developers – Part 1

Excelsior Prosperity w/ Shad Marquitz – Substack – 08-15-2024

https://excelsiorprosperity.substack.com/p/opportunities-in-gold-explorers-and

Great stuff Shad as that really brought me up to speed on WRL. More info summarized quickly than I could have hoped for.

Ok. Took a little moving things around but back in. 52 week high is shown as 1.04 and current Venture price .66. Thanks Ex for the input I needed.

Thanks Lakedweller2.

Just some silver info.

https://silverseek.com/article/samsungs-silver-solid-state-battery-technology-1-kilogram-silver-car